Big Tech Primary Adopter of AI So Far; Adoption by Non-Tech Picking Up

Earlier this year, a shockwave landed in the artificial intelligence space with the news that Udi Manber, who used to run search engineering at Google, was joining the health insurer, Anthem to head up its AI group. After all, it’s not every day that industries with reputations for spurning tech and collecting reams of paper land a preeminent technologist in a burgeoning field.

But the move by Anthem could be a sign of the shift in how companies and industries think about artificial intelligence and whether it is relevant to their businesses. While in the past, AI may have been considered the province of large tech companies, increasingly non-tech firms are embracing how it can improve their performance.

In this article, we look at the artificial intelligence market and analyze which industries are investing in AI and what that means exactly in terms of useful applications that are being implemented today, and what this means for the AI talent market.

We found that much AI investment is currently dominated by large tech companies like Google, Amazon, Baidu and Microsoft. However, between 10% to 30% of non-tech companies are also adopting AI technologies, depending on the industry.

While non-tech companies have yet to play a large role in artificial intelligence investment, the current market is a fraction of its projected size. Put differently, AI is at a very early stage in its development and industries that invest heavily in the next few years can still be ahead of the curve.

The term artificial intelligence typically refers to automation of tasks by software that previously required human levels of intelligence to perform. While machine learning is sometimes used interchangeably with AI, machine learning is just one sub-category of artificial intelligence whereby a device learns from its access to a stream of data.

When we talk about AI spending, we’re typically talking about investment that companies are making in building AI capabilities. While this may change in the future, McKinsey estimates that the vast majority of spending is done internally or as an investment, and very little of it is done purchasing artificial intelligence applications from other businesses.

In 2016, McKinsey pegs that approximately $34 billion was spent on artificial intelligence development. The vast majority of that was internal corporate spending.

Internal Corporate spending makes up $23 billion of AI investment, nearly three times more than the current levels of venture capital and private investment in the space. This massive amount of investment is not evenly distributed among firms, however. McKinsey estimates that tech giants like Google and Baidu spend $20-30 billion per year on AI, the vast majority of this category spend.

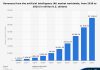

Outside of big tech, the amount of spending is minimal so far. Part of the way this phenomenon shows up is that the market for AI software is still quite small. According to Tractica Research, the amount of spending for 2018 was forecast to be less than $10BN.

While current levels of external spending on AI software are dwarfed by internal spending today, the AI software market is expected to grow rapidly to nearly $90BN by 2025. For companies that are still considering their level of investment in AI, it may be comforting to know that the market is still a fraction of its future potential and they are not necessarily behind the curve.

Still, machine learning and artificial intelligence are sometimes (erroneously) used interchangeably. This error is perhaps not surprising given that machine learning is the largest category of investment within the AI landscape:

62% of AI spending in 2016 was for machine learning, twice as much as the second largest category computer vision. It’s worth noting that these categories are all types of “narrow” (or “weak”) forms of AI that use data to learn about and accomplish a specific narrowly defined task. Excluded from this report is “general” (or “strong”) artificial intelligence which is more akin to trying to create a thinking human brain.

Industries Adopting AI

Which industries are at the forefront of AI adoption? Within any industry, there is a heterogeneity of firms and sub industries with different adoption trends for AI, so a framework for considering which industries are good candidates for AI adoption may be helpful.

Investor and AI entrepreneur Bradford Cross suggests that industries that are large (high market capitalization) and profitable (high gross margin) would be good initial targets for AI application adoption. Using that framework, tech, financial services and healthcare would qualify as good initial industries for AI applications. Cross also notes that you see a lot of successful startups targeting some of these industries:

“This is a good example where the data are all aligned — fintech and healthcare are the largest markets with the highest margins and the most representation among both unicorns and AI startups. So these are solid markets to aim at.”

Read the source article at Priceonomics.

from AI Trends https://ift.tt/2KJQ9ey

via IFTTT

Comments

Post a Comment